Condo Insurance in and around Fort Worth

Welcome, condo unitowners of Fort Worth

Condo insurance that helps you check all the boxes

Your Personal Property Needs Protection—and So Does Your Townhome.

Being a condo owner isn't always easy. You want to make sure your condo and personal property in it are protected in the event of some unexpected trouble or loss. And you also want to be sure you have liability coverage in case someone stumbles and falls on your property.

Welcome, condo unitowners of Fort Worth

Condo insurance that helps you check all the boxes

Protect Your Home Sweet Home

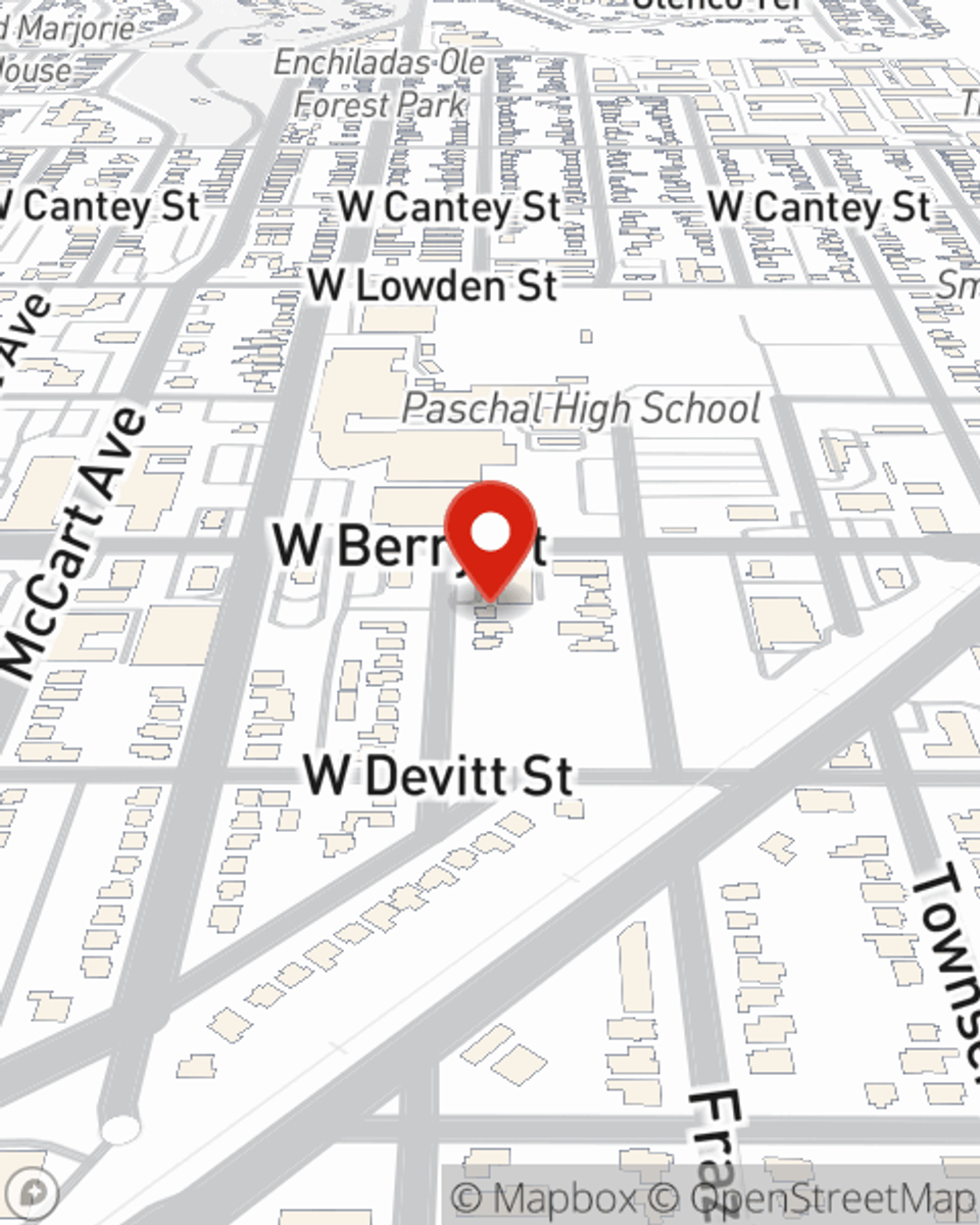

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unexpected with dependable coverage that's right for you. State Farm agent Esmeralda Gutierrez can help you discover all the options, from possible discounts, bundling to liability.

Terrific coverage like this is why Fort Worth condo unitowners choose State Farm insurance. State Farm Agent Esmeralda Gutierrez can help offer options for the level of coverage you have in mind. If troubles like drain backups, identity theft or wind and hail damage find you, Agent Esmeralda Gutierrez can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Esmeralda at (817) 923-2886 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Esmeralda Gutierrez

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.